Senior Nomad Budget Travel

Easy, Safe, Fun!Senior Nomad Budget

We haven’t yet talked about your senior nomad budget plan. I’m sure you realize that it’s the foundation for all aspects of roving retirement. I left it for later on purpose though since frankly, it’s just not a fun task. But I’m hoping that by now you’ve generated a lot of excitement about your own nomadic lifestyle prospects. Enough excitement and motivation to you get over this boring budget bit.

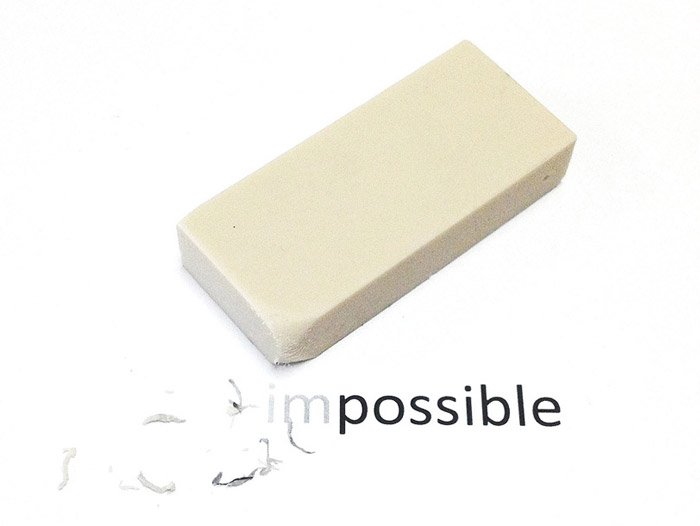

Fortunately, there’s no magic monthly number to shoot for. There’s such an amazing amount of flexibility in this lifestyle that you can do it on almost any budget. But you still have to know exactly where you are now as a starting point. And if you haven’t done this budget exercise in a while, chances are you’ll uncover several places where you can make some fast and painless cuts to what’s going out the door.

Since financial assessment and planning is not my area of expertise, I’ll only go over this topic in broad generalities and share with you my personal perspectives. (Note: My finances are very simple. If yours complex, I recommend you seek out a qualified professional to assist you.)

I believe that adopting a roaming lifestyle can actually be of great benefit to you financially. Designed properly, you can live better, for less money than when living rooted in one place.

Your current picture

If you already have a thorough understanding (plus spreadsheets filled with numbers to prove it) of your overall financial picture, congratulations!! You’re way ahead and can skip this section.

For the rest of you, it’s time to make more spreadsheets. Fortunately, there are lots of websites out there that can help you with this process. I suggest you search on: “free household budget spreadsheet” or “personal budget template”.

Look through the results and download some to see if they fit for you. A good one should have categories that you can relate to plus ones that you may have overlooked. It should also be modifiable. You want to be able to easily delete unnecessary categories and add more that better reflect your personal situation.

Also search on “free net worth template” and get a second spreadsheet designed for that. You’ll need both.

Then dig out any stacks of receipts and records you may have stacked in a corner or back closet, and prepare to get to work. It’s time to sort through them and see the cold hard facts. Brutal honesty is needed here. (Personally, a cold rainy day and high levels of caffeine get me through this part.)

Budget

Everyone knows what a budget is… listing all your income and all your expenses in one place. Usually on a per month basis since that’s how most people receive income and pay their bills.

If you’re retired like me, income is fixed. That’s the easy part. So the only real advice I can offer is with regards to getting an accurate picture of your current ongoing expenses.

- Do not just guess at what you are spending in a particular category. Really add up the actual costs, based on receipts (credit card or paper). Do this preferably over a year’s time frame and then divide by 12. Being human we’ll want to fudge the numbers to what we think we should be spending.

For example, you may put down $35 a month for beauty services such as haircuts and getting your nails done because you think that’s “reasonable”. But now you go back through and really add it up all up (including tips!) based on your actual number of visits over the past year. And oops! It’s really been $67 a month! You may not like the numbers you get, but knowing is much better than not knowing as we’ll see later.

- Make sure to list all your quarterly, semi-annual and annual expenses. Amortize them so you can see the monthly impact. For example, if you pay homeowners or renters insurance annually, divide it by 12 and put that into your monthly budget.

- Be sure to add in estimates for even longer cycles and items that you need to plan for but are not hard fixed amounts.

For example, if you have a car, then car maintenance needs to go into your monthly budget based on what you normally spend over a year. Or maybe you regularly upgrade your computer every 3 years. In that case, take a look at the current cost of one that you would consider comparable. Then divide that number by 36 and add to your monthly budget.

- Ferret out every expense you possibly can and enter it into your budget. Even the things that are often overlooked.

For example: birthday/holiday/special occasion gifts. New holiday decorations. Furniture upgrades. Annual memberships or donations. Office supplies. Hobbies. Annual drivers license, fishing license, car tag renewals. Software upgrades or annual anti-virus subscription. Parking. Pets including all their food, medication, toys and vet visits. Stamps and postage. Yard care. Magazine subscriptions. Books. Shoes, clothing, jewelry. Handbags and suitcases. Electronics like TV’s, stereos, GPS, etc. Kitchen ware and appliances. Entertainment – movies, music/videos, sporting events, concerts. Taxi, train, bus, toll roads, airfare. Vacations plus hotels, motels. Entrance fees to museums, parks, tourist attractions. Annual professional services such as tax prep and accounting. All types of insurance. Any medical expenses not covered by insurance.

(Yes I know putting all this in writing can be agonizing. But it really is worth it, honest.)

- Enter as many separate line item expenses as you can get a handle on. Then group these entries into natural categories.

For example, don’t just enter one nebulous number for entertainment. Put in all the different line item details, each with their separate amounts. Then have the spreadsheet add it, giving you the real total for that overall category.

- Do you still need to pay taxes? Or service any outstanding debt? Put that in as well.

Net worth

Here’s where you write down everything you own and it’s value plus everything you owe. It’s the big picture of your financial health. I only have a couple words of advice here…

- List everything you can think of, even if you may not usually consider it an asset like investments, a home, a car and bank accounts. Make a separate category and list things like your furniture, all the equipment in your garage/office/kitchen, electronics. Even jewelry and clothing. (There’s a reason for this… it will make playing with what-if scenarios easier later.)

- Put down a low-ball estimate, not a high one. How much could you sell your house for next month? Not waiting for a high sellers market. How much are all your possessions worth right now if you had to liquidate them on auction? Not what you paid last year, or current replacement value. But what someone else would realistically pay for the item, used, in as-is condition. No sentimental value added.

The good news is that the really hard part is over. Next it’s time to have some fun playing with “what if” possibilities.

How could nomad traveling change this?

This section is all about expanding your horizons and possibilities. It’s thinking about adding some new things into your life and taking other things out. It’s about seeing the overall financial impact of each scenario while simultaneously imagining and feeling into what your daily life would then be like.

If the new scenario moves your financial barometer in a positive direction while also bringing a big smile to your face and excitement to your eyes, then you’re likely on to something. I’d say it’s time to delve deeper into that one and see how far it goes.

Make sure you keep your real spreadsheets you worked so hard on in a safe place. Make copies where you can tweak the numbers and see what happens. More copies again, for different scenarios you might explore.

For example, what if you sold your house and downsized into a small condo in a cheaper city? What if instead you kept your house/condo and rented it out for 6 months a year while you explore the world? Or could you put all your belongings in storage and rent out your place unfurnished long term?

The possibilities are endless here, and only you will know which ones to even start to consider as plausible options.

Here’s some questions to help you with various scenarios.

- Looking at your budget, which items wouldn’t be there you didn’t have a house or apartment? What if wherever you “lived” was all inclusive (no utilities, cable, garbage, maintenance, etc.)

- And if you didn’t need a car? What expenses would then disappear? Can you imagine being some place (or multiple places) where public transportation is quite sufficient?

- Remember to substitute the cost of living expenses (groceries, eating out, transportation) in the locations you’ll be traveling to for your current expenses in those categories. So if food and drink will only cost a third of what you pay now, you’ll gain some savings in your monthly budget.

- Are there any items in your current budget that are way higher than you thought? Did any expenses pop up that look super simple to cut? Anything you wouldn’t want/need much if you were traveling more? For example, if you were spending lots of time walking or swimming would you still need the gym membership? If you did more sidewalk people-watching or gazing at sunsets are there other “entertainment” costs you might be willing to give up? (Remember those priority lists you made!)

- And here’s one to play with that’s usually much easier for renters to wrap their head around than homeowners… what if you had no permanent home at all? Do any expenses instantly fall away? Is there anything else you could slice away that doesn’t really bring you joy?

I hope by now that the pain of collecting and recording your senior nomad budget has been justified. My goal was to have this exercise reveal new, exciting and viable roving retirement lifestyle options for you.

However, I do recommend you go slow here and don’t dive into the deep end. Even if you uncover a new scenario that looks perfect and propels you instantly into full time travel. Take some smaller steps first. Try traveling for 2 months. Then 4 months. If you can, up the travel time each time while maintaining a fall back option as your safety net. Just in case you change your mind.

In the next article we’ll talk about your possessions in more detail. What would happen if you had less “stuff” in your life. But that really is a separate topic, way too big to include here.